Do you ever want to know how much a health care service is going to cost you before you schedule the appointment? We know your money is important to you, and you want to know what you pay for health care. The easiest way to understand what costs you're responsible for is to understand what the financial terms mean.

Premium

A premium is the monthly amount you and/or your employer pays to your health care company to keep your coverage. Think of it like a gym membership - it's what you pay to be a Blue Cross member. Premiums vary based on what expenses are covered in a plan.

Copayment (or copay)

Your copay is a fixed amount you pay for a covered health care service, usually when you get the service. Copays vary depending on where you received care. A visit to an urgent care center will have a higher copay than your primary provider.

Deductible

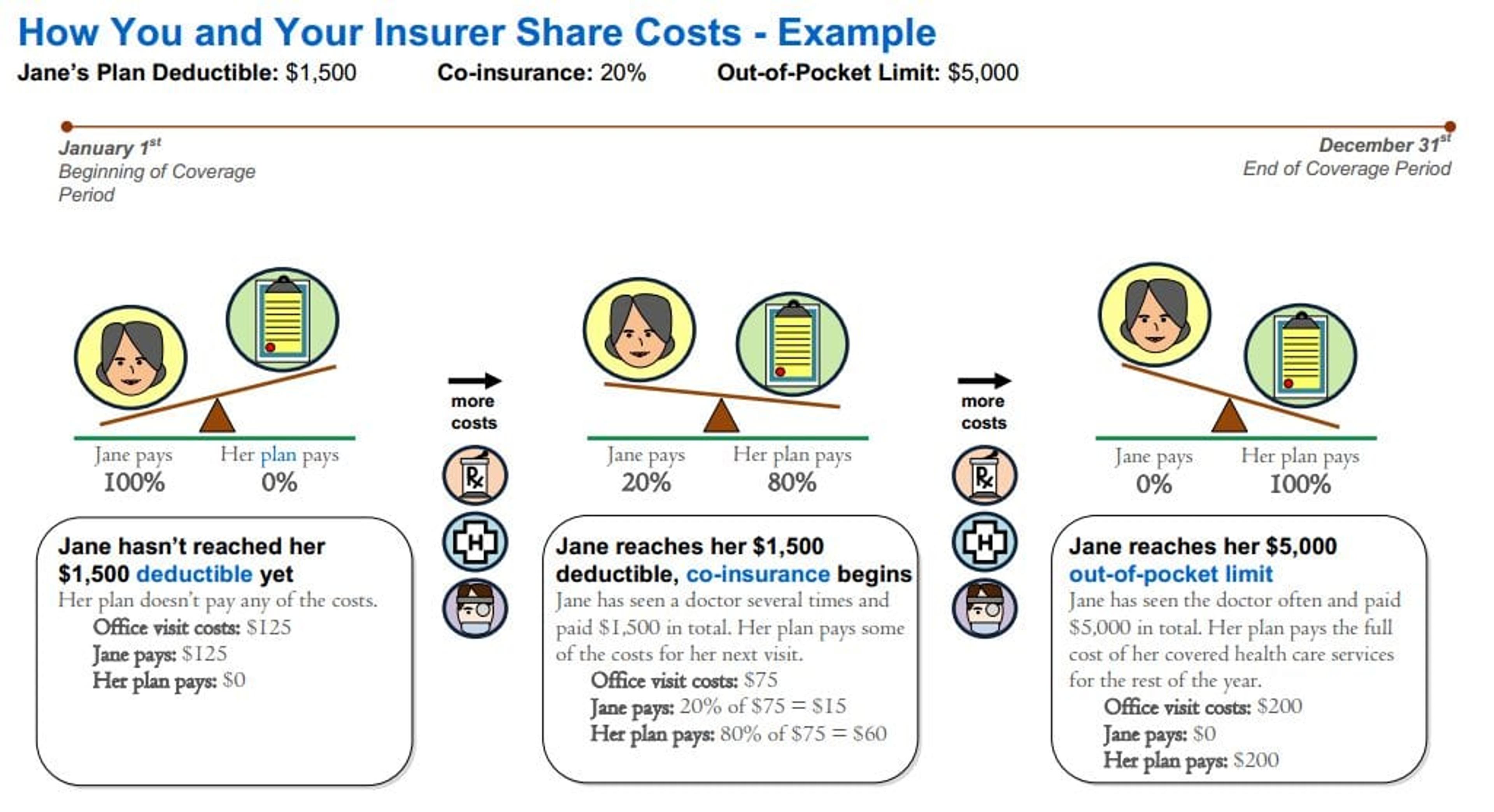

A deductible is the amount you owe for health care services before your health insurance plan begins to pay. You will generally pay the full price of health care costs until your deductible is reached. Preventive services such as your annual wellness visit are covered by your insurer and don’t count toward the deductible.

Coinsurance

Coinsurance is your share of the costs of a covered health care service, usually a percentage (for example, 20%) of the allowed amount for the service. A 20/80 coinsurance means the consumer pays 20% of the costs and the insurance company picks up the remaining 80%.

Out-of-Pocket Maximum

Your out-of-pocket maximum is the most you'll pay in deductible, copayment and coinsurance during the year. Once the out-of-pocket maximum is hit, your health insurer will typically cover 100% of what is owed for covered services.

Preventive care

Some benefits, like preventive services, are paid 100% by Blue Cross with no copay. Take advantage of your preventive services to stay healthy and minimize your out-of-pocket health care costs. Learn more about preventive services at bcbsm.com.

Here are more blogs to help you understand your health insurance:

- What Does My Health Plan Cover?

- 5 Health Insurance “Unknowns” Explained

- How to Make the Most of Your Health Insurance

Photo credit: People Images, Infographic: Center for Public Health Practice & Leadership at UC Berkeley