Members Benefit from Blue Cross’ Diverse Business Model

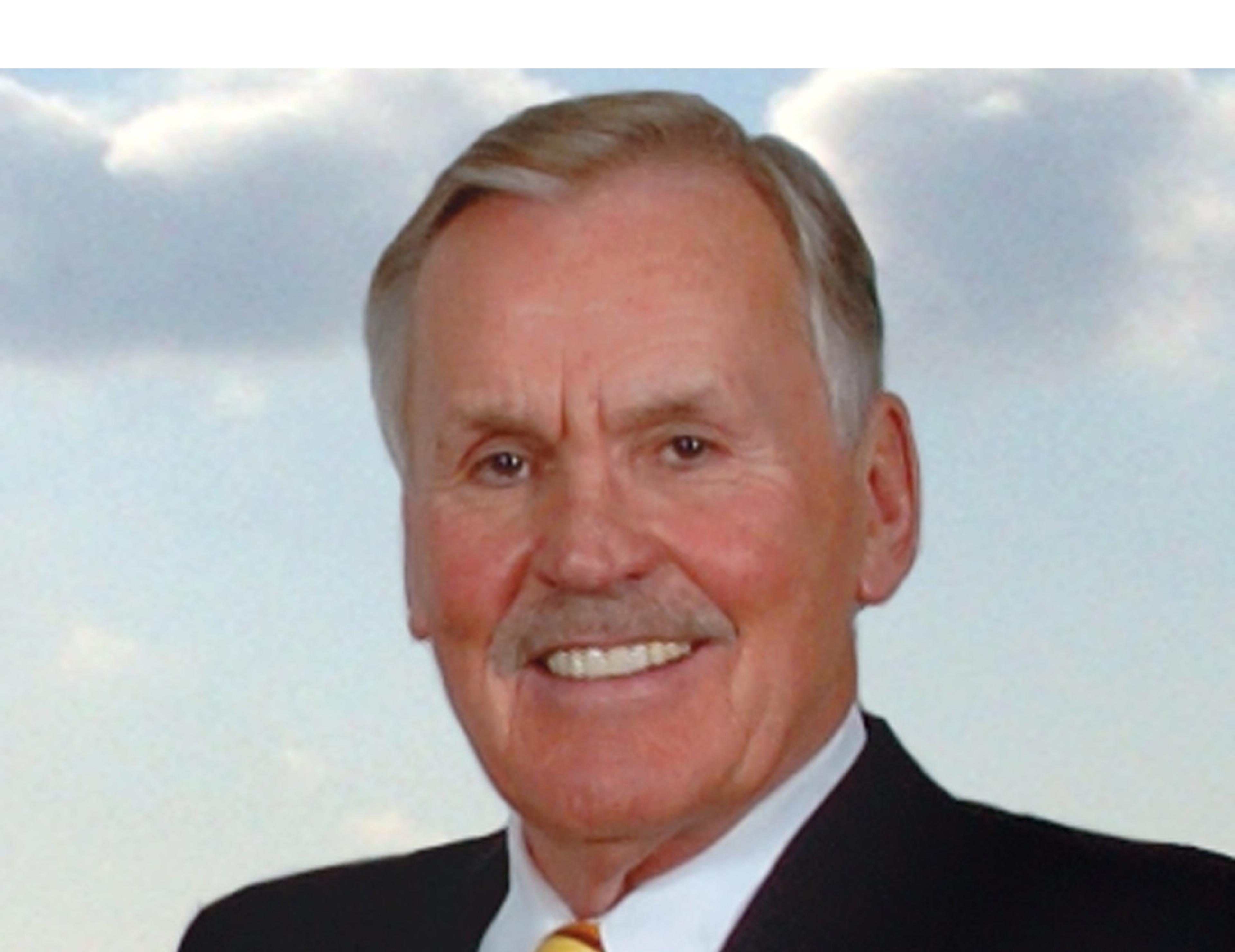

Daniel J. Loepp

| 2 min read

Daniel J. Loepp is the former President and Chief Executive Officer of Blue Cross Blue Shield of Michigan.

When you think of Blue Cross Blue Shield of Michigan, you think of health insurance. It makes sense – we’ve been offering security and peace of mind in Michigan communities for more than 80 years.

But the Blue Cross of today is more than a trusted health insurance company: under our Blue Cross mutual umbrella is an increasingly diversified portfolio of businesses that provide much more than health insurance, including multiple subsidiaries operating across all 50 states.

For example, Blue Cross Blue Shield of Michigan includes a specialty benefits company that offers accident and hospital recovery insurance, critical illness insurance, final expense and term life insurance, as well as long-term care insurance. Our enterprise also includes a health care technology company that offers claims processing, customer service and provider data management, as well as a nationally recognized company whose affiliated brands provide specialty and workers’ compensation insurance solutions across the U.S.

Why does this matter to our health plan members and customers? This diverse portfolio of businesses allows us at Blue Cross to enhance the core mission of our company to serve our members with high-quality, affordable health insurance while investing in our communities and managing costs.

As a nonprofit mutual, Blue Cross generates revenue across three categories: premiums and administrative fees paid by customers; income from our for-profit subsidiary companies; and returns on our investment portfolio. The revenue from our diverse subsidiaries has allowed us to weather unpredictable and unprecedented events without passing on the costs to members.

During the COVID-19 pandemic, for example, Blue Cross put more than $2.1 billion behind our response, including absorbing member cost sharing, providing premium refunds to some group customers and rebating premiums to individual members. This was made possible by our diversified business model.

Blue Cross continues to look for ways to diversify our business beyond health insurance and we are excited for new opportunities to expand our portfolio. As a diversified business, we are better equipped to keep health care costs affordable and predictable for members and group customers, while offering high-quality health care solutions and a best-in-class provider network.

We’re ready to help, no matter what the future may bring.

Daniel J. Loepp is president and CEO of Blue Cross Blue Shield of Michigan.

Photo credit: Getty Images