As Blue Cross works to help 200,000 of our members understand rate increases we filed July 6 with state regulators, it’s important for us to explain how those increases will affect our bottom line as a company. Because that bottom line matters to the 5 million people who carry our insurance.

- Blue Cross will not profit from these increases. The prices we submitted to regulators for Legacy Medigap have a lifetime loss ratio of 110 percent – meaning that Blue Cross will spend $1.10 of every $1 we earn in premiums.

Given this, how is this a good move for Blue Cross? The simple answer is that it keeps our Legacy Medigap plans financially sustainable for the long term. They are not today – given that our loss ratio is above 150 percent today. Here is some more information:

- These will be the first rate increases for Legacy Medigap since 2011.

- Rates for Legacy Plan C – the plan owned by 90 percent of our Medigap members – have risen only four times in the past 16 years. The total increase over that time in Legacy C monthly premium is less than $33.

- Our rates are significantly below the cost of providing medical care to our members because we have raised monthly premiums by just $33 in 16 years – a time when the average yearly health care cost for a family tripled to well over $20,000 per year.

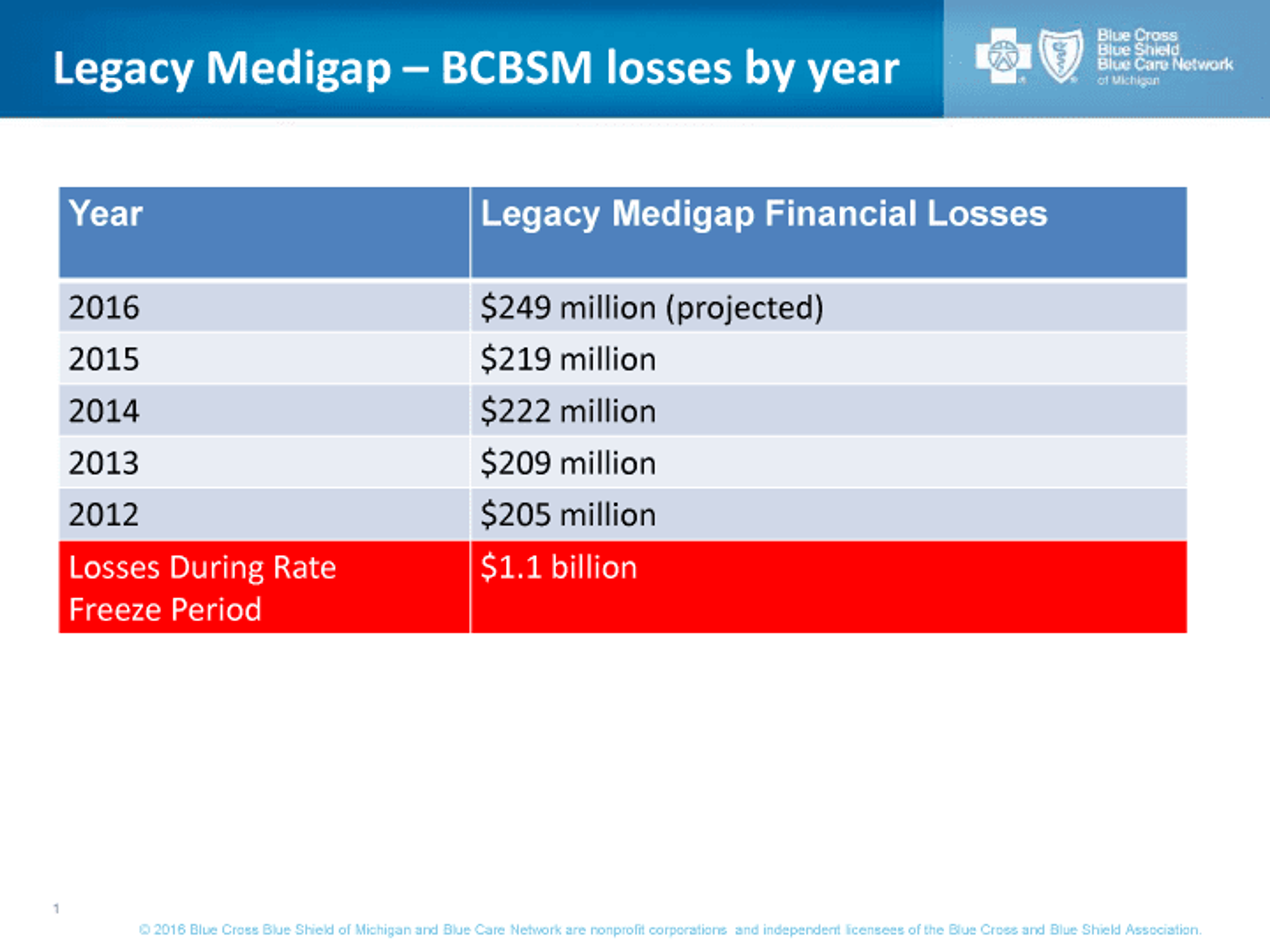

- Blue Cross has lost $1.1 billion on Legacy Medigap since 2011. These huge financial losses – driven by products owned by just 4 percent of our membership – put stress on the health insurance costs for the other 96 percent of our membership.

Blue Cross is making a determined effort to continue to offer popular Medicare Supplement coverage to our members at prices that are on parity with our competitors – prices that more accurately represent the true cost of providing health care services. This is how we can best represent all 5 million of our members’ interests through this process affecting 200,000 people’s rates.