RELEASE

Blue Cross Blue Shield of Michigan and Blue Care Network approved to offer 44 individual health plans in Michigan for third-annual open enrollment period

bcbsm

| 3 min read

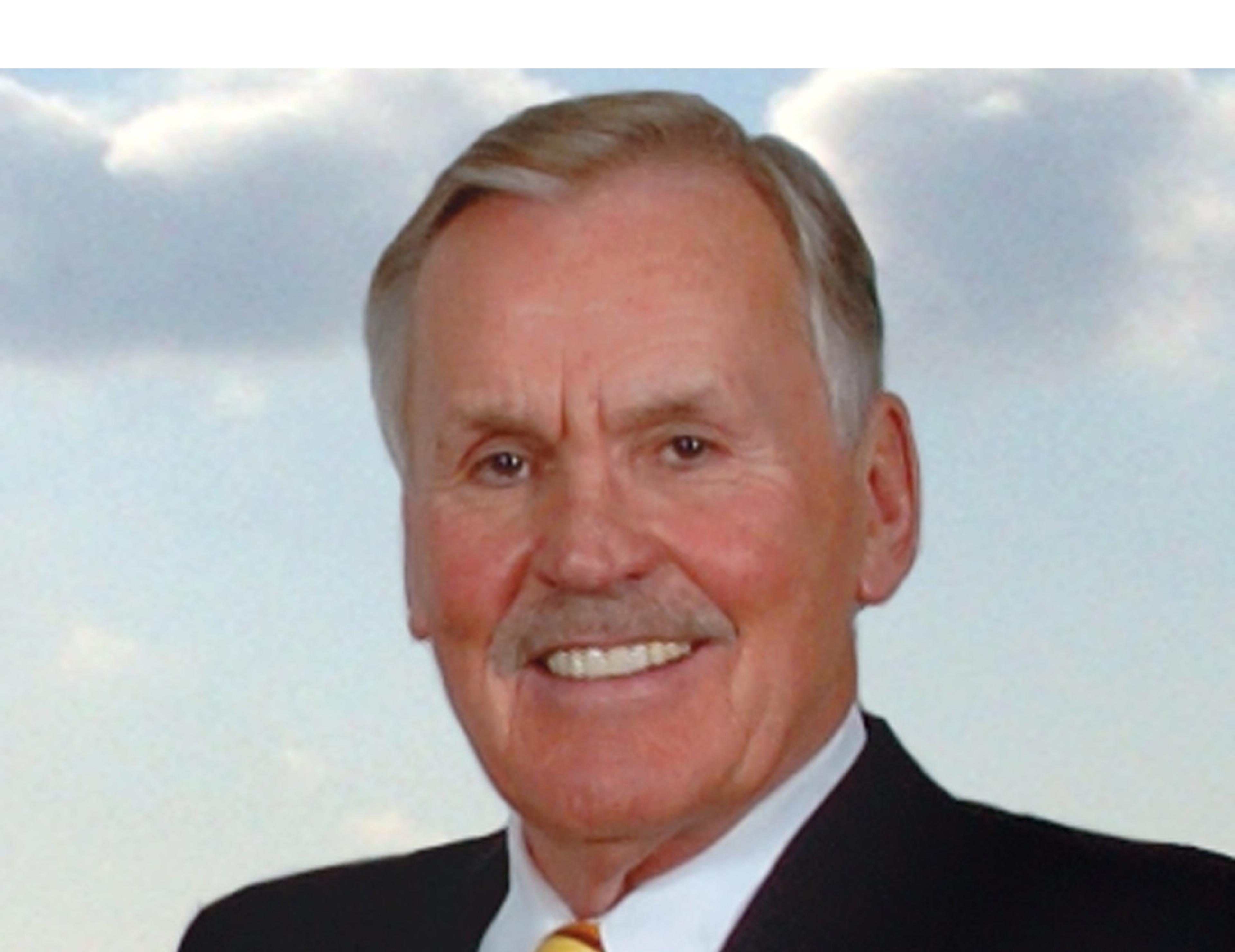

DETROIT, Oct. 13, 2015 – Blue Cross Blue Shield of Michigan and its HMO subsidiary, Blue Care Network, will continue to offer a wide range of affordable health insurance choices to Michigan individuals and families during the 2016 open enrollment period, which begins Nov. 1. Blue Cross received approval from state and federal regulators to offer 44 product options at a variety of competitive price points. “Blue Cross continues to be the only health plan to offer coverage in all 83 Michigan counties, something we have done since the Marketplace launched in 2013,” said Terry Burke, vice president for Individual Business for Blue Cross. “Michigan is our home. We are committed to making sure every Michigan resident has access to health insurance that meets their health and financial needs, regardless of where they live in the state.” With 16 insurance companies filing to do business on the Marketplace for the 2016 product year, Michigan continues to be one of the most competitive markets in the nation for health insurance. Despite this intense competition, two out of every three Marketplace enrollees chose Blue Cross Blue Shield of Michigan or Blue Care Network as their plan last year. Blue Cross’s 44 individual market products include nine new options, providing consumers with even more choices to best meet their individual needs. Blue Cross and Blue Care Network will again both offer plans at the Gold, Silver, Bronze and Catastrophic levels. Highlights of the 2016 offerings include:

- Products built on local networks of hospitals and doctors in Metro Detroit and Grand Rapids provide additional health plan options to cost-conscious customers that prefer to receive care close to home.

- Blue Cross offers the lowest priced “Catastrophic” PPO health plan in 72 of Michigan’s 83 counties on the 2016 Marketplace, representing 87 percent of the state.

- New, simpler plan designs will make it easier for consumers to understand their costs:

- In the new Bronze Saver plan, the only number members need to know is their deductible. This plan is designed so the deductible equals the out-of-pocket-maximum, and approved services are covered 100 percent after it’s met.

- The new Platinum plan demystifies the complexity of most cost-sharing designs by offering a 10 percent coinsurance on all approved medical benefits packaged with all ages dental and vision.

- Blue Cross is the only health plan to offer a Platinum PPO option on the 2016 Marketplace. The Premier Platinum with Dental and Vision plan offers members a simple plan design with the richest metal level of coverage on Michigan’s broadest network.

“Blue Cross is offering a wide variety of health insurance choices and price points because that’s what people told us they are looking to have offered to them,” Burke said. “Michigan residents want affordable, quality coverage with a cost-sharing design they understand and doctors they trust.” The new products become available to Michigan consumers on Nov. 1, when the federally run Health Insurance Marketplace begins taking applications for open enrollment. Products will be available through independent certified Blue Cross agents and also directly through BCBSM and BCN at bcbsm.com/myblue. Consumers can also call a Blue Cross health plan advisor at 1-855-237-3501. Blue Cross Blue Shield of Michigan and Blue Care Network of Michigan are nonprofit corporations and independent licensees of the Blue Cross and Blue Shield Association. For more company information, visit bcbsm.com and MiBluesPerspectives.com.

###