When you’re choosing health insurance, you’ll come across the acronyms PPO and HMO. These are the two main types of health insurance plans.

PPO is the acronym for Preferred Provider Organization, and HMO stands for Health Maintenance Organization. Both types of plans have a network of physicians, hospitals and other health care professionals that agree to provide medical services at pre-negotiated prices and rates.

Nearly 30,000 doctors and more than 150 hospitals work with Blue Cross Blue Shield of Michigan and Blue Care Network.

- Our PPO network: As a Blue Cross Blue Shield of Michigan member, you have access to all of the hospitals and more than 95% of the doctors in Michigan.

- Our HMO network: As a Blue Care Network member, you have access to more than 6,800 primary care providers in all 83 counties. You also have access to more than 22,800 specialists and more than 150 hospitals.

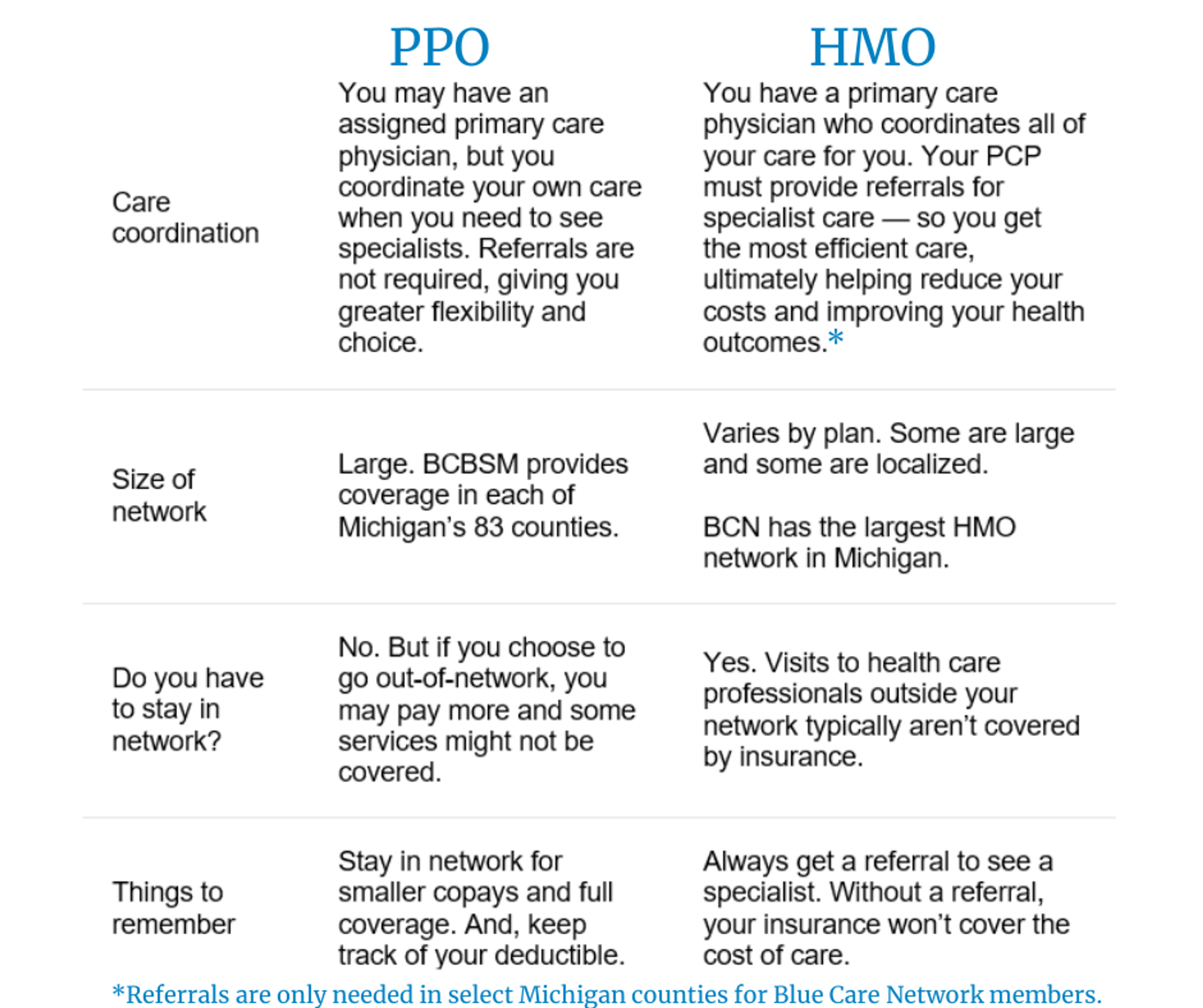

The difference between HMO and PPO plans

What's the difference between these two types of health plans? Here's a chart to break it down:

How to decide between HMO and PPO

Picking the right type of insurance plan for you comes down to the type of arrangement that works best for you and your dependents. You should evaluate your health care needs and financial situation to make the best choice for you.

Questions to ask yourself:

- How often do you need to go to the doctor? How complex are your health care needs?

- How important is cost?

- How important is it to be able to see whatever doctor you want, any time?

For example, if you only expect to see your primary care provider once a year for an annual physical and you’re on a tight budget, then the lower monthly premium costs of an HMO may make the most sense.

For others who have complex care needs and want to be able to see doctors at any facility, the flexibility of a PPO may be the best choice for them.

Learn more about what Blue Cross Blue Shield of Michigan is doing to make health care more affordable.

Photo Credit: Getty Images

Related: